23.06.2020 Trading

I did a bit of backtesting and analysis last night and this morning, trying to figure out what is the best strategy to trade. There were 3 entry approaches I compared.

- Channels

- Fib extensions

- Stop hunts

The best results for these 3 seemed to come from stop hunts, which is a bit surprising because the RRR is actually the worst of these. But the results were also pretty close, so not a massive difference.

The one approach I did not include in the test is HVFs. These seem to make a lot of sense and allow for great RRRs.

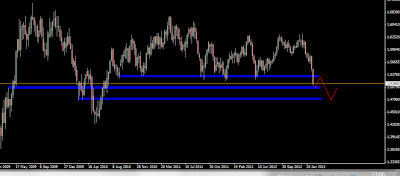

So here is an HVF entry in the SPX500 which targets a channel extension. Risk is very low. I suspect the likelihood for success on this one is low, as we have already seen great gains in the morning.

12:55

I have no idea how I did not get stopped out. Chart says stop was triggered. But it looks like it's going to crap on me anyway very soon.

15:10

Just wasted some money on this setup. How come my backtest shows predictive setups should work?

15:15

Another that is a bit out of boredom because I am not getting or missed entries.

And...it's gone. The fastest crap trades ever!

16:23

I just can't stop, another long in SPX500 at stophunt lows. Entry was good, SL moved to breakeven, which likely means it's a zero trade, as DAX is not joining the action and sells off further.

Comments

Post a Comment