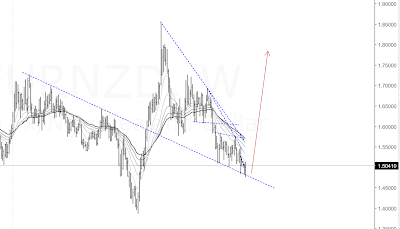

$EURUSD is rejected at channel support

Just when nobody in the mainstream media is willing to bet a dime on the EUR is finally starts to show a sign of life at an important technical price level. Is this the start of a counter-trend rallye? Only time can tell, but the technical picture suggests that we will possibly see prices in the high 1.07s or even above 1.08 in the near future. Depending on how price "travels" there, I will be looking to sell into those levels. *All ideas presented here are my personal opinions and not investment advice. Take responsibility for your own risks and trades!