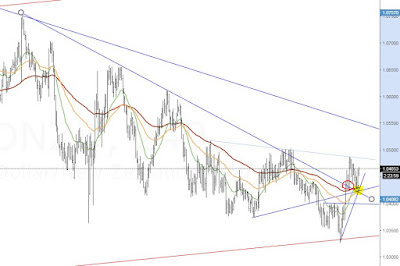

The slow sell-off in $USDCHF could come to an end very soon

I wrote about the Swissy a few weeks back, eyeing bullish targets around 1.06 and higher. The recent grind lower in $USDCHF has been a bit frustrating. Over the last week the pair stagnated in about an 80 pip range, so nothing to see or do. But looking at the weekly chart, I still think my long-term bias is justified as the averages are bullish. The trendlines come in at around 0.9935 and 0.9885 and should provide some support or possibly the springboard to reach the initial targets which have of course only gotten better. If these lines fail though, I will run and cover my a$$... *All ideas presented here are my personal opinions and not investment advice. Take responsibility for your own investments, risks and trades!