The markets are a puzzle

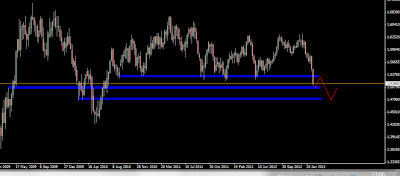

And that to me is part of the fascination. Example: The SNB put a floor beneath EUR/CHF. Now they are holding billions of assets already making them "the biggest hedge fund of Europe". The Eurozone as a monetary union is in deep s*** and it seems only additional devaluation can preserve the union and enable politicians to kick the can down the road. If we look at a chart like EUR/AUD or EUR/NZD we see that the it is overripe for at least some kind of technical retracement. But Australia and New Zealand are the only two big currencies still paying at least a little bit of interest, which capital is generally seeking. In Switzerland on the other hand, which fundamentally and fiscally might be one of the soundest countries, negative interest rates are a reality. No way to weaken the Swissy and take off some appreciation pressure with this tool. Something's got to give folks! Solve the puzzle and make your bet! :)