Market Briefing 27/02/2013

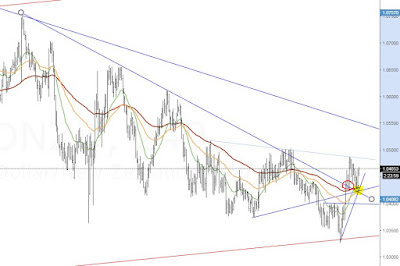

The markets have finally come out from anaesthesia in the last couple of days. The focus has shifted away from Abe's easing plans, with the Italian election providing a new political headline. This has given the yen a breather, retracing some of the massive moves that we have seen over the last couple of months. EUR was sold in response to concerns over Italian election results, while USD is quietly strengthening more or less in stealth mode against almost all currencies.

I see the short-term yen strength as a buying opportunity and will continue to build up short JPY positions. With the dollar I am a bit cautious. I have a hunch that the USD might once again emerge as the least ugly currency in the short- to medium-term. A reduction in the US trade deficit (less oil imports?) can be the fundamental driver besides the Fed talking about an end of or less monetary easing.

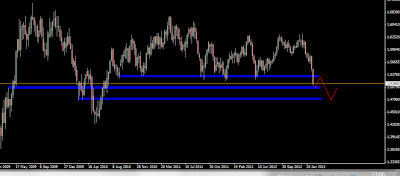

It will be interesting to see the consequences for AUD and NZD if commodities correct further. The high-flyers have a lot of room the fall, particularly against EUR and USD. I will welcome these corrections because I think they will some day provide great buying opportunities, but for now I will not build up big positions in those pairs. Also, RBA is expected to stay dovish, potentially cutting rates to say 2.5% this year.

Interesting times ahead.

Good luck with your investments!

I see the short-term yen strength as a buying opportunity and will continue to build up short JPY positions. With the dollar I am a bit cautious. I have a hunch that the USD might once again emerge as the least ugly currency in the short- to medium-term. A reduction in the US trade deficit (less oil imports?) can be the fundamental driver besides the Fed talking about an end of or less monetary easing.

It will be interesting to see the consequences for AUD and NZD if commodities correct further. The high-flyers have a lot of room the fall, particularly against EUR and USD. I will welcome these corrections because I think they will some day provide great buying opportunities, but for now I will not build up big positions in those pairs. Also, RBA is expected to stay dovish, potentially cutting rates to say 2.5% this year.

Interesting times ahead.

Good luck with your investments!

Comments

Post a Comment