22.06.2020 Trading

9:17

Took 2 long entries on the SPX500 1 min chart. One was stopped, the other is still active.

Beautiful winner on the second entry!!!

10:33

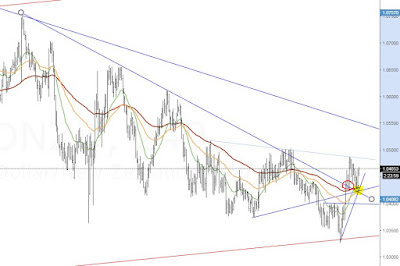

Next long entries in SPX500 (Oanda's S&P) 1 min chart. The correction has been slow and not given clean opportunities. So I am stuck in a premature entry and a good one, both at channel supports. I did not trade the third channel as its entry is roughly equal to the previous one.

10:38

My first entry has been cancelled at BE. The second one looks good now. Profit target is set at 3103.8 for 3R, if it can get there.

10:42

Stop to BE after nice follow through. Now the markup stalls at the 127.2% extension.

10:50

Got filled on my TP. Nice!!!

11:51

I went long on the SPX500 3 min chart. Stop-loss is set at 3097,3.

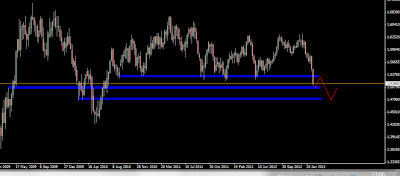

But there is a bigger picture channel pushing in the opposite direction.

12:04

The SPX is almost stopping out my trade. But I saw that the DAX looks much nicer as it does not seem to have this immediate bigger picture resistance. So I hastily took a DAX long on the 3/5 min chart.

12:13

SPX is stopped out for -1R.

12:20

And here is me still wishing for upside and entering another long in SPX on the 5 min chart. Maybe I should stop switching timeframes completely?

Another observation for my DAX long. Yes, the DAX looks bullish, but it had not even retraced 38.2% of its previous move when I took the long entry. That is too early!!! See below:

Comments

Post a Comment