Market Briefing 06/04/2013

What a week! The Japanese, in a hurry to destroy their currency, have shifted into the next gear increasing their monthly quantitative easing to something like 7 trillion yen. I couldn't even write that number. In comparison to the Fed's QE that is like 2.5 times as much I understand from Zerohedge. Insane! But what choice do they have? Bankruptcy? Not until the looting becomes uneconomical because all wealth has been taken.

Feels like time is running out and the big global grabfest has started. That is also the headline for Cyprus.

I heard that the Fed is buying around 90% of all issued US government bonds. What a scam! And the US is currently still the most beautiful of all ugly swines.

Ok, let me look at some charts.

First the S&P:

The S&P's situation is a bit vague. Was this a breakout? Was it not? To me it looks like it stepped over the line and the 1540/1550 level is currently support. Which does not mean it can't. Clearly, the breakout is struggling to gather momentum. A pullback could bring us back down to the 1450/1475 level.

The DAX:

The DAX obviously failed to surpass the resistance at 8000 and yesterday pulled back to touch 7625. This is actually a nice entry point, but it's already too late. The DAX popped up 50 points from there to end the week at 7679. If 7625 does not hold I see targets of 7450, 7125 and then 7000 as nice levels.

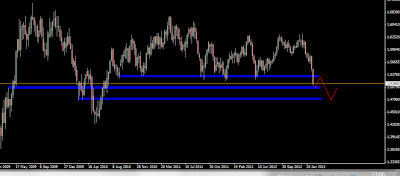

In the forex markets the yen's decline is the dominating scheme. Where could it stop? Against CAD a resistance zone could delay the drop next week. I would expect the pair to be stuck for a while between 93.75 and 97:

Ok, that's it for now. I am happy I managed to not lose money on my accounts even though my beloved silver longs have gotten hammered. Support at 27 in silver has held for now, but I doubt it will bring a huge pop up. Time to play defense on silver. I sold almost all my yen shorts. I will build them up again in case of a pullback. These one way markets are tough for me.

Feels like time is running out and the big global grabfest has started. That is also the headline for Cyprus.

I heard that the Fed is buying around 90% of all issued US government bonds. What a scam! And the US is currently still the most beautiful of all ugly swines.

Ok, let me look at some charts.

First the S&P:

The S&P's situation is a bit vague. Was this a breakout? Was it not? To me it looks like it stepped over the line and the 1540/1550 level is currently support. Which does not mean it can't. Clearly, the breakout is struggling to gather momentum. A pullback could bring us back down to the 1450/1475 level.

The DAX:

The DAX obviously failed to surpass the resistance at 8000 and yesterday pulled back to touch 7625. This is actually a nice entry point, but it's already too late. The DAX popped up 50 points from there to end the week at 7679. If 7625 does not hold I see targets of 7450, 7125 and then 7000 as nice levels.

In the forex markets the yen's decline is the dominating scheme. Where could it stop? Against CAD a resistance zone could delay the drop next week. I would expect the pair to be stuck for a while between 93.75 and 97:

Ok, that's it for now. I am happy I managed to not lose money on my accounts even though my beloved silver longs have gotten hammered. Support at 27 in silver has held for now, but I doubt it will bring a huge pop up. Time to play defense on silver. I sold almost all my yen shorts. I will build them up again in case of a pullback. These one way markets are tough for me.

Comments

Post a Comment