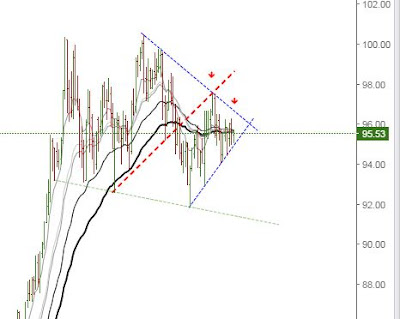

Is the dollar index signalling continued Fed dovishness?

The $DXY is trading in a increasingly compressed range, coiling up for an explosive move in either direction.

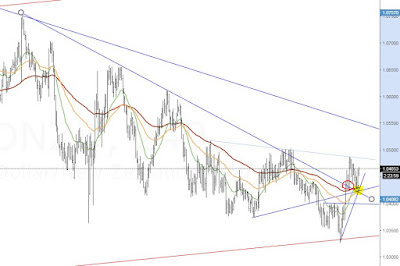

After breaking the red uptrend line I am favoring $USD weakness which could be triggered by the Fed keeping rates at their current levels and not hiking in December as widely expected. Should this scenario materialize, a possible target will be the light green trendline that is currently coming in slightly below 92.

*All ideas presented here are my personal opinions and not investment advice. Take responsibility for your own risks!

|

| $DXY weekly chart |

After breaking the red uptrend line I am favoring $USD weakness which could be triggered by the Fed keeping rates at their current levels and not hiking in December as widely expected. Should this scenario materialize, a possible target will be the light green trendline that is currently coming in slightly below 92.

*All ideas presented here are my personal opinions and not investment advice. Take responsibility for your own risks!

Comments

Post a Comment