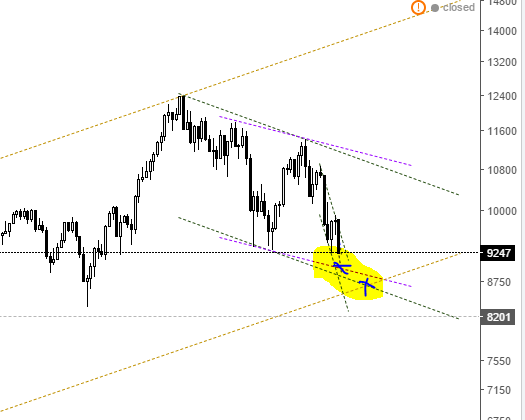

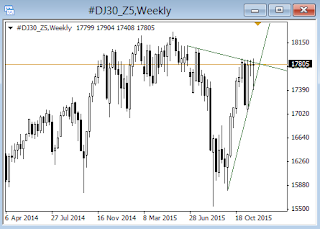

The $DAX has been a beast lately. But can it accelerate out of its bullish channel?

The German index has reached the upper end of a channel that the massive stock rallye since trump's election has completed. But can it even increase its pace and blow out to the upside of this projection? It Certainly feels once more like the markets are unstoppable with corrective moves ending shallower than California's ground water levels. My fear and ego certainly don't allow me to buy at these levels, so I will observe for weakness in this beast... *All ideas presented here are my personal opinions and not investment advice. Take responsibility for your own investments, risks and trades!