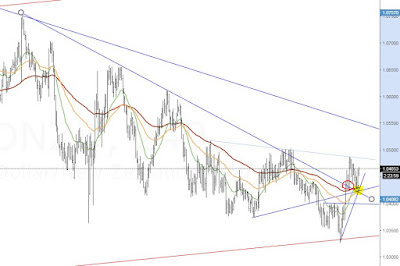

A roadmap for $AUDNZD

After months and months of bear market activity $AUDNZD is finally signalling bullish resistance. $AUDNZD on the 4h chart The downtrend was violated (red circle) and was tested from the upside for a bullish rejection. I entered a small long at 1.0427 which I intend to hold as long as the pair is not violating the young uptrend. Longer term targets will be in the 1.0850 - 1.09 area, which currently is the intersection of a projected channel and a bearish trendline. Should the price action form a bearish pattern earlier I am bailing out of this scenario and bets are off for me. $AUDNZD daily chart *All ideas presented here are my personal opinions and not investment advice. Take responsibility for your own risks and trades!